WANT TO BE A WIZARD AT CRYPTO TRADING? HERE’S WHAT NOT TO DO!

Cryptocurrencies are the rage in the economy, but as more keep making investments in these, how individuals deal with money changes. Cryptocurrencies have been replacing liquid cash nowadays, because of the various advantages they provide. People have been investing in them and doing more research in order to know more about them.

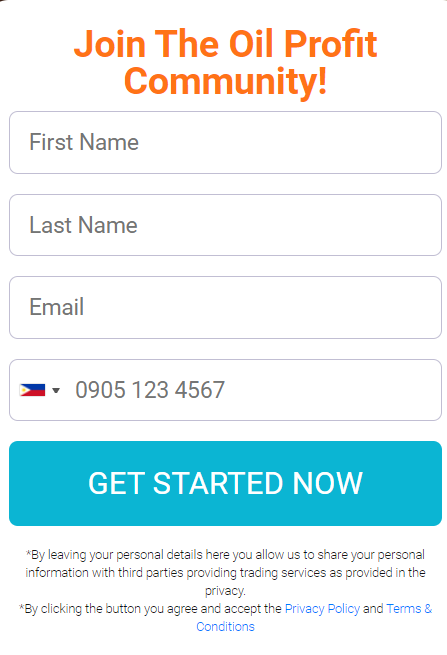

People might wonder where they can find out more about bitcoin and other cryptocurrencies. Bitcoin software can help them with that and more. So click the image below to find out more.

However, these are several tactics and recommendations to keep in mind whilst speculating in cryptocurrencies.

- There are a few explanations why one cannot become a top crypto trader. So there are some things people should avoid during crypto trading. Let’s see what these are:

- One should not personify the markets: The industry has no human qualities, but several people speak of it as if it does. As a result, many individuals have a profound misunderstanding of how markets work. The marketplace is the sum of all trade of goods and services, not a private individual against which you must contend.

- Avoid the hidden investment contradiction: The invisible expenditure phenomenon is when you stay involved with anything easy because you have a lot of money invested in it. Time, effort, money, and even sentiments are examples of possessions. Strive not to snare defeat from the mouths of victory by falling in love with a commodity.

- Buying based on a hunch: Buying based on suspicion is the most dreadful blunder that many amateurs make. It may frequently result in substantial financial supporters buying high and selling cheap. Many novices only need to ride the trend and profit without evaluating the currency’s prospects since certain variables prop up the coin’s amount. Slightly earlier this year, speculations about a massive amount of crypto usurpation, along with a more widespread crypto market rise, drove both corporate and business investors to acquire various currencies at extravagant prices.

Cryptocurrency economies are unpredictably volatile, making it difficult to anticipate potential value growth. Financial supporters who acquired experimental currencies on the incoming flooding suffered losses next week due to an unforeseen fall in crypto markets, which is blamed on Tesla’s bitcoin ban. The selloff was aided by the expansion of Chinese rules and vulnerabilities.

- Gathering all of your resources in one location: It’s arguably the most significant blunder most rookie investors make. If you want to gamble with crypto coins, it’s a good idea to split your bets over several different improvement techniques. Putting a large amount of money into one cash might jeopardise your future contributions. Inventory improvement is often regarded as an ancient method of reducing the risk of substantial loss.

Each drop-in currency value is a safe investment by nestlings. They also believe that buying during a bull market is an excellent strategy to take advantage until the price rises too much. Financial supporters are in grave danger of losing money in these situations. Before entering a significant position, it’s critical to understand the reasons behind each boom or fall market.

- Whenever you acquire, plan the evacuation plan: Buying any resource, particularly a digital coin, without a departure strategy may be disastrous. To reach your primary goals, you should have your stop procedures and a behavioural system in place long in advance. If the business condition descends into chaos, it is impossible to allow disasters to accumulate. Wealthy backers can use leave methods to help moderate excessive disasters.

Unlike equities, economic benchmarks, and other commodities, Cryptographic types of money are theoretical organisation influences, and their value is directly related to receptions and economic evaluations. All while market analysts have discovered reliable on-bind metrics for valuing cryptocurrencies. It is still unclear whether making buying or selling choices based on specialised factors is a good idea, mainly based on real-world themes and instances.

Conclusion

A well-known approach is to measure future execution using primary factors. Whichever method funders use; the risk of capital losses increases if they don’t follow basic principles.